How To Get A Cheap Card Payment Machine

The cheapest card machine or the cheapest portable card payment machine are 2 of the most

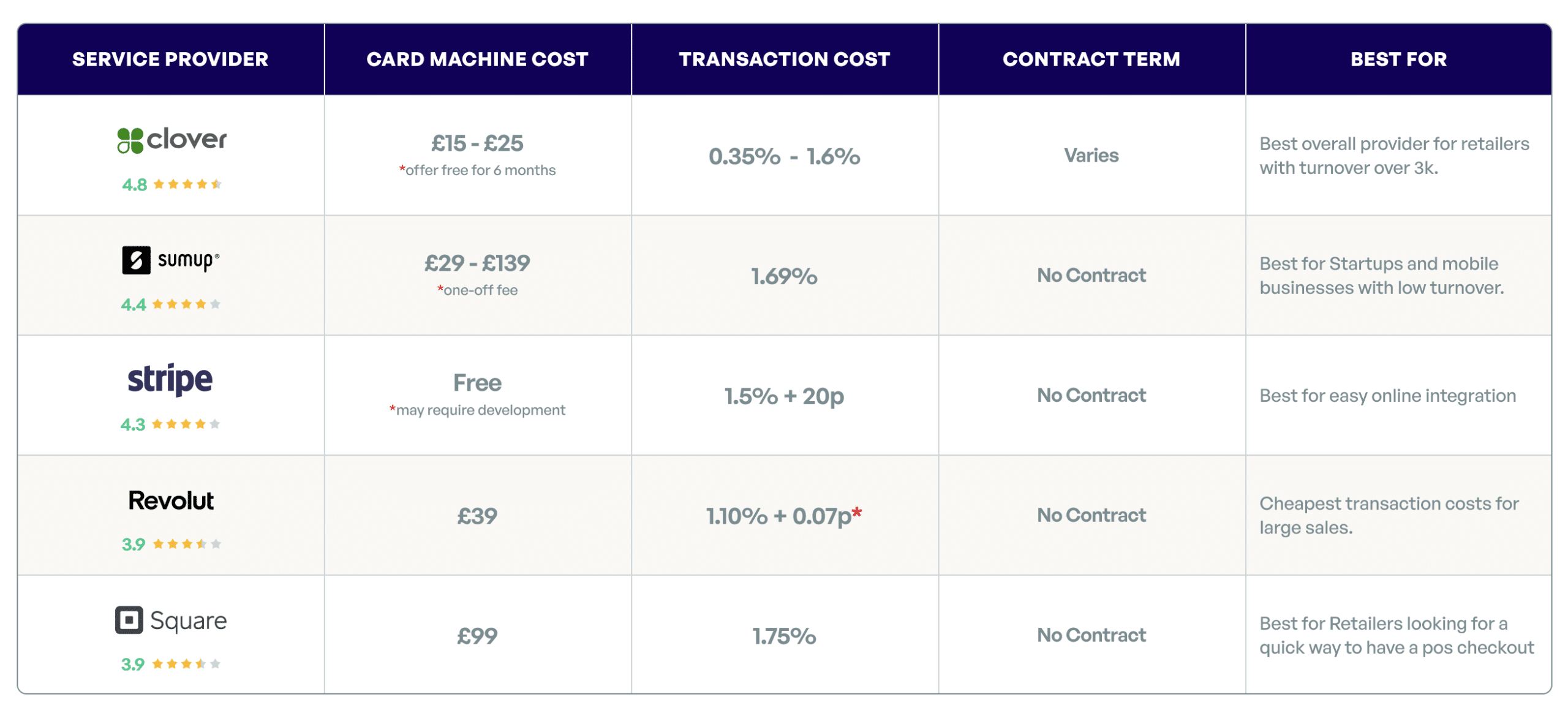

If you search card merchant service provider on Google you will find tons of articles with a wide range of claims on what’s best for customers “ who need immediate access to funds” or “ best for brand reputation”. Let us make the decision easier for you, for 60% of SMEs in the UK, all you need to worry about is 2 things: the price you will pay for the card machine and transaction cost, and if you’re willing to be tied into a contract.

For the other 40%, you may need a card payment solution that’s a little more bespoke, if you need payment options for the occasion sale or need something that will integrate into your e-commerce website you might need a payment provider more suited to your needs. In this article, we review multiple providers so you can better understand which merchant service is best suited for you.

Merchant account service providers are a bit like choosing an electricity provider, the quality of electricity provided is hardly going to change if you switch providers, the main reason people switch is due to cost.

The rest of this article will take an in-depth look at all the factors involved in selecting a merchant service account, but if you want to skip all the reading below and simply want to find the cheapest one, just see which of the statements below fits you best and follow the link(s) below.

What of the following applies statements best reflects what you’re looking for?

– Who does this statement typically apply to?

– Any business turning over 3k a month or more.

– Use our comprehensive search engine and get prices costs on screen here

– Who does this statement typically apply too?

– Startup businesses, retailer with low or irregular income and those that just don’t want to be tied down!

Compare all PAYG merchant account providers here

A merchant service provider is a bank specialising in card processing that provides businesses with the capability to facilitate electronic payment transactions.

They enable businesses to accept various forms of payment such as credit cards, debit cards, and mobile payments, from their customers.

Merchant service providers act as intermediaries between the business, the customer, and the payment networks, ensuring secure and efficient payment processing.

Some merchant services buy rates from the bank directly but do not actually provide the card processing service. Although these companies are intermediaries they often have cheaper rates than the bank directly, a little bit like the car insurance sector.

There are several other things to consider other than price when choosing a merchant account, although this isn’t an exhaustive list here are the elements, we think matter most after cost:

Payment processing companies can charge a variety of fees to merchants, and the charges will be mainly dependent on your turnover, the type of card machine you require and if you need online services.

Card processing fees vary massively as you will see on our merchant service comparison engine.

Here is a list of common fees payment processing fees charged my merchant service providers in the UK:

Key Points: For a retailer with low sale value like a corner shop with auth fee can drastically increase the value of the total bill.

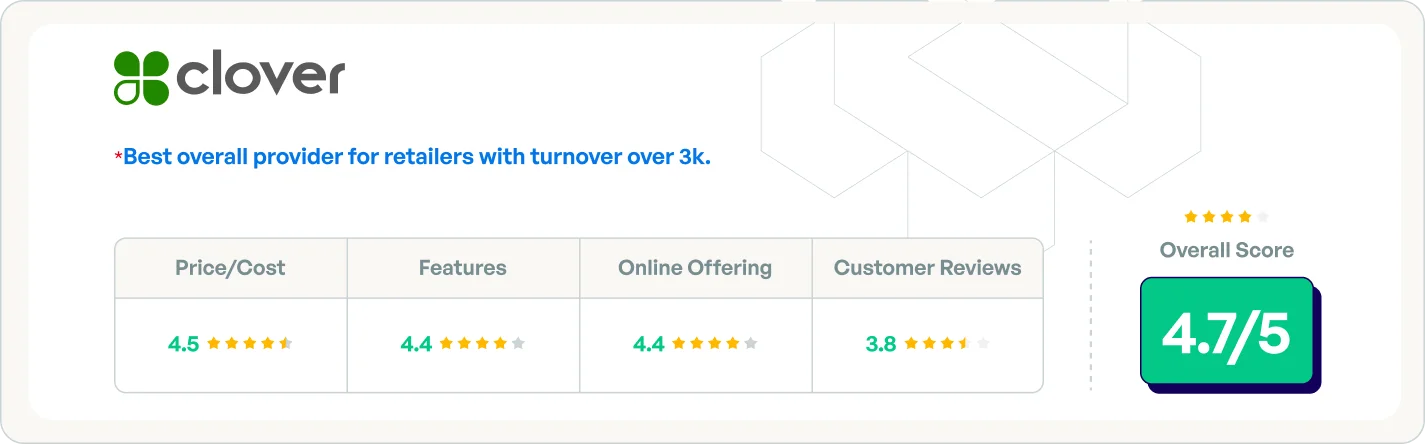

1. Clover/Fiserv: Best all round merchant service provider.

As the UK’s leading price comparison site for payment processing our most important review metric is price, regardless of how you wish to take payments: instore, online or over the phone Clover provides exceptional value. Transactions fees are typically low, with debit card processing rates starting from 0.35%. Although a min 6-month contract is typically required and Clover might not be best option for startups or businesses with a turnover under £3000, for everyone else Clover is a solid choice.

Service levels are also outstanding, our own platform data suggests over 96% of customers have remained with Clover 12 months after signing up with them, suggesting real brand loyalty.

Clover has a sliding scale for transaction costs, so as your business grows your costs will reduce. Clover also has an excellent virtual terminal and online payment gateway meaning businesses can scale without having to worry about using multiple providers.

Although the online payment gateway is not as easy to integrate or familiar for developers as Stripe, transaction costs mirror instore fees which would mean substantially lower costs (stripe charge 1.5% -2.5% per card transaction). The customer journey isn’t quite as slick as Stripe’s, but we would still rate clover’s offering a solid 4/5*

Clover’s card machine offering is also impressive, unlike many of the outdate designs provided by the likes of Worldpay, all Clover card terminals are touchscreen designs, easy to use and equally easy on the eye

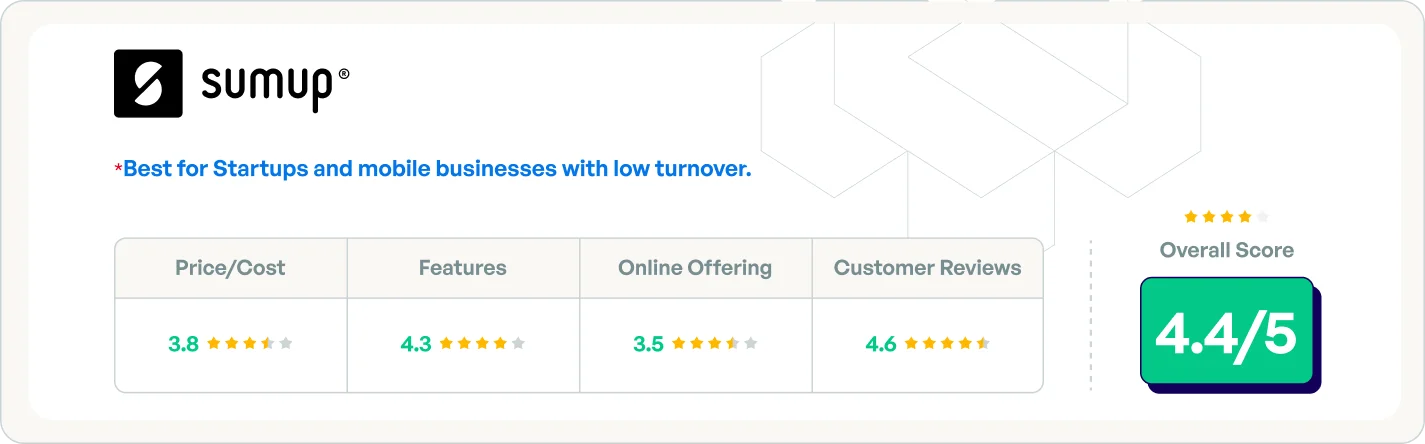

2. Sumup Air: Best for startups and retailers with low volumes per month.

Sumup together with the likes of Square and iZettle have changed the payments landscape in the UK over the last decade. They offer a card reader for a tiny one-off payment (£39) with no monthly contract, providing a perfect solution for anyone wanting to dabble with card payments. Sumup’s slightly lower processing cost of 1.69% vs 1.75% for the izettle and Square give it the slight edge over its rivals.

The Sumup card reader is very easy to use, just sync to the mobile app and off you go. The platform is extremely intuitive and customer service for startups is outstanding.

If your business makes sales of less than £3,000 a month or you need a backup for the odd occasion a customer wants to make a card payment, Sumup is the ideal solution for you. But if you’re starting to grow it might be time to switch to a traditional merchant bank such as Clover to keep your costs down.

** we would recommend using a different provider for both virtual terminals and payment gateways due to high fees.

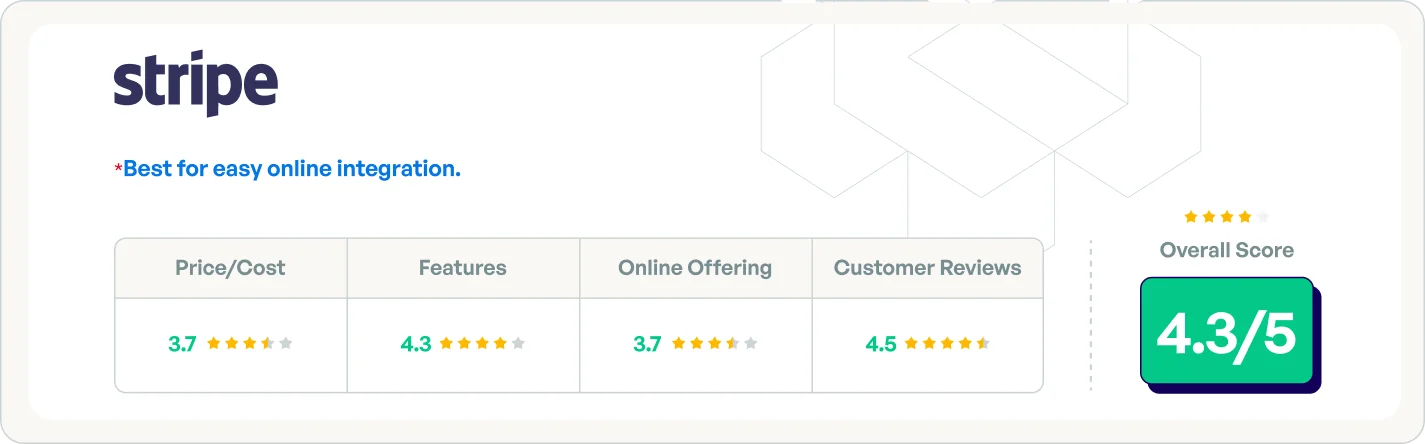

3. Stripe: Quickest way to take payments online.

Stripe is a market leader for online payments and has made its name by providing a quick and easy solution which integrates with pretty much any website.If you’re looking to offer an online payment solution and your current platform doesnt already do so, Stripe could be the solution for you.

Unlike with most merchant services, stripe provide instant approval for most, saving time on form filling. Stripe integrates with all major platforms including: Woocommerce, WordPress,Magento and Drupal amongst many others.

Customer reviews suggest the platform is very well built, reporting is outstanding and as the platform is so intuitive, training is rarely required.

Although we believe Stripe provides an outstanding platform, the transaction fees are significantly higher than a merchant bank, who would typically charge you the same card processing fees instore as well as online, with a small monthly fee for the gateway. This is the price you pay for instant approval and for and easy integration

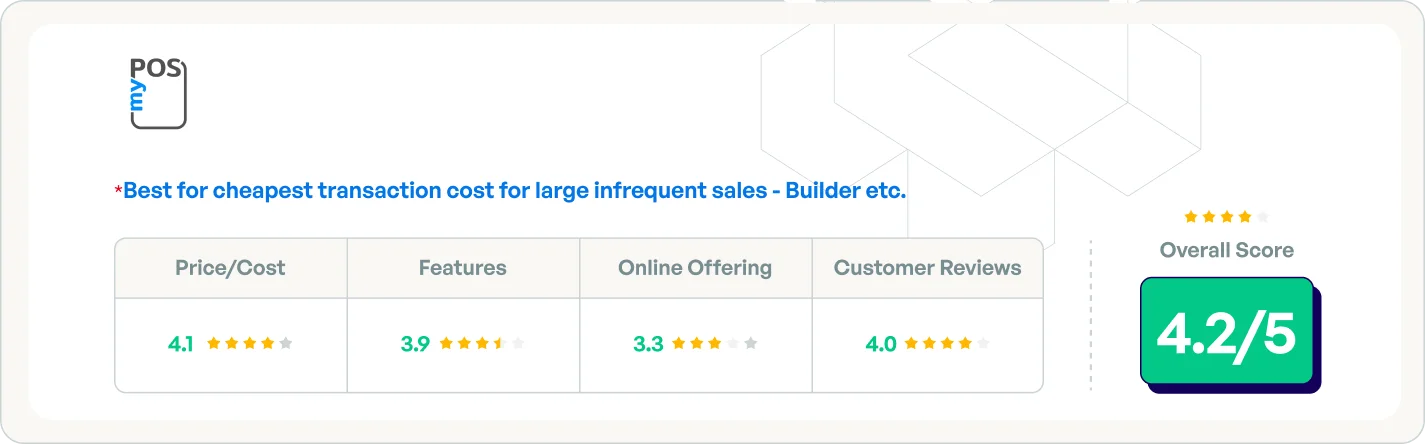

4. MyPos: Portable Card Reader – cheapest transaction costs for some.

Mypos standalone portable card reader is an effective competitor to Sumup, Square, and Izettle. Although the device perhaps isn’t as stylish as the other trio, it does most things the market-leading card readers do, and with a transaction fee of 1.10%+ 7p if your business takes few transactions but with a high sale value (over £300) then the low % cost can bank you a significant saving!

If you’re an established business we would still recommend an established traditional card machine and offering like Clover simply because it’s cheaper. But if you’re a builder who makes sales via card payment once in a while Mypos’s portable card reader could be the right solution for you.

The other key advantage of Mypos is that it’s a standalone device, unlike some of its competitors’ basic card readers, mypos’s portable card reader doesn’t require connection to a smartphone and is connected to the ether via a 4g sim card with no monthly costs.

Mypos merchant services have a solid backend and you can easily send digital receipts via SMS or email directly to the customer. Settlement is instant and the app is designed extremely well. There is a huge amount to like about Mypos as a whole.

Pricing is slightly different for online payments (we would recommend other options for online sales)

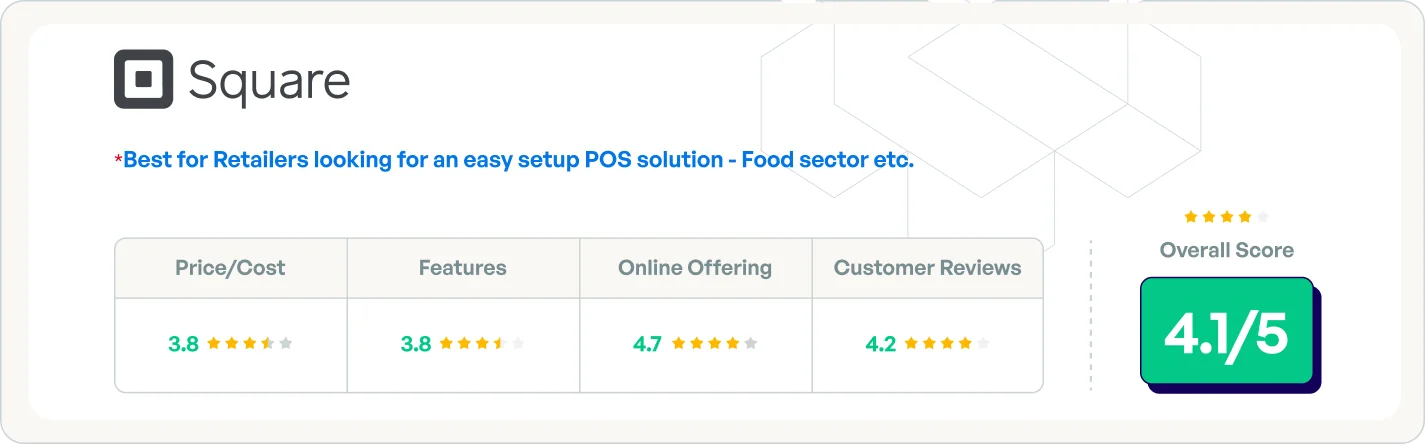

5. Square Stand (iPad required): Best for retailers adding multiple items to a basket.

I know what you’re thinking, aren’t iPads rather expensive? These days you can pick one up for a few hundred pounds and together with the square stand, it can have a transformative effect on your checkout journey. The key advantage to the Square stand is that it allows you to display your products and services to create baskets more easily.

This can work particularly well for certain businesses like restaurants or food vans, as you can see from the image above it makes the process of identifying what the customer wants much easier and therefore makes the checkout process quicker and more interactive.

The tech is pretty smart too, the card reader is built directly into the stand and interacts with the iPad seamlessly. The swivel stand neatly allows the retailer to add up the products sold and swivel around for the customer to see itemised billing and costs. The minimalist design looks great in any surrounding, leaving your countertop clutter-free.

The square stand won’t be for everyone, it’s more costly than other simpler merchant service options which would work perfectly fine for most businesses but could be particularly useful in the food and beverage sector.

If your business has grown to over £3000 of card turnover per month, Clover will likely be the most cost-effective solution for your business. They provide a wide range of card machines and their online offering is excellent. Above all else, the pricing is significantly cheaper than the alternative mentioned so if this is what matters to you, stick with Clover

If you’re just starting or require a different style of machine Square, Sumup and Mpos now provide excellent alternatives depending on your requirements, whilst Stripe has long been the merchant’s service provider of choice for online sales if you want to get up and running quickly.

*Get quotes in seconds

Sandip Patel is the Founder of Compare Card Processing and an expert in the payment processing industry. Sandip has over 10 years of experience directly in merchant banking, having worked with some of the top brands in the country to reduce their merchant service bills. Compare card processing was created with a simple vision, to make cheaper card processing bills more accessible to retailers across the UK. Our articles are aimed at educating retailers to make the most informed decisions regarding their merchant services. Sandip Studied Economics and Nottingham University and has been published in mainstream media including Mail Online, and This is Money

The cheapest card machine or the cheapest portable card payment machine are 2 of the most

The card payments industry in the UK is big (a whopping £75 trillion big, according to

Top 5 Best Card Processing Services in the UK for your business.

Unfolding the best card reader for your small business in 2023.

Compare Card Processing is a trading name of Savepay Ltd. Reg in England No. 10147163. Registered Office: International House, 24 Holborn Viaduct, London, EC1A 2BN.

* All your information is held securely and we never give your details to 3rd parties.

Compare Card Processing is a trading name of Savepay Ltd. Reg in England No. 10147163. Registered Office: International House, 24 Holborn Viaduct,

London, EC1A 2BN.

Compare Card Processing: Your go-to site for insights to choose the ideal provider for your card processing needs.

© 2024 Compare Card Processing. All Rights Reserved.

Compare Card Processing is a trading name of Savepay Ltd. Reg in England No. 10147163. Registered Office: International House, 24 Holborn Viaduct, London, EC1A 2BN.

* All your information is held securely and we never give your details to 3rd parties.

* All your information is held securely and we never give your details to 3rd parties.

© 2024 Compare Card Processing. All Rights Reserved.